[ad_1]

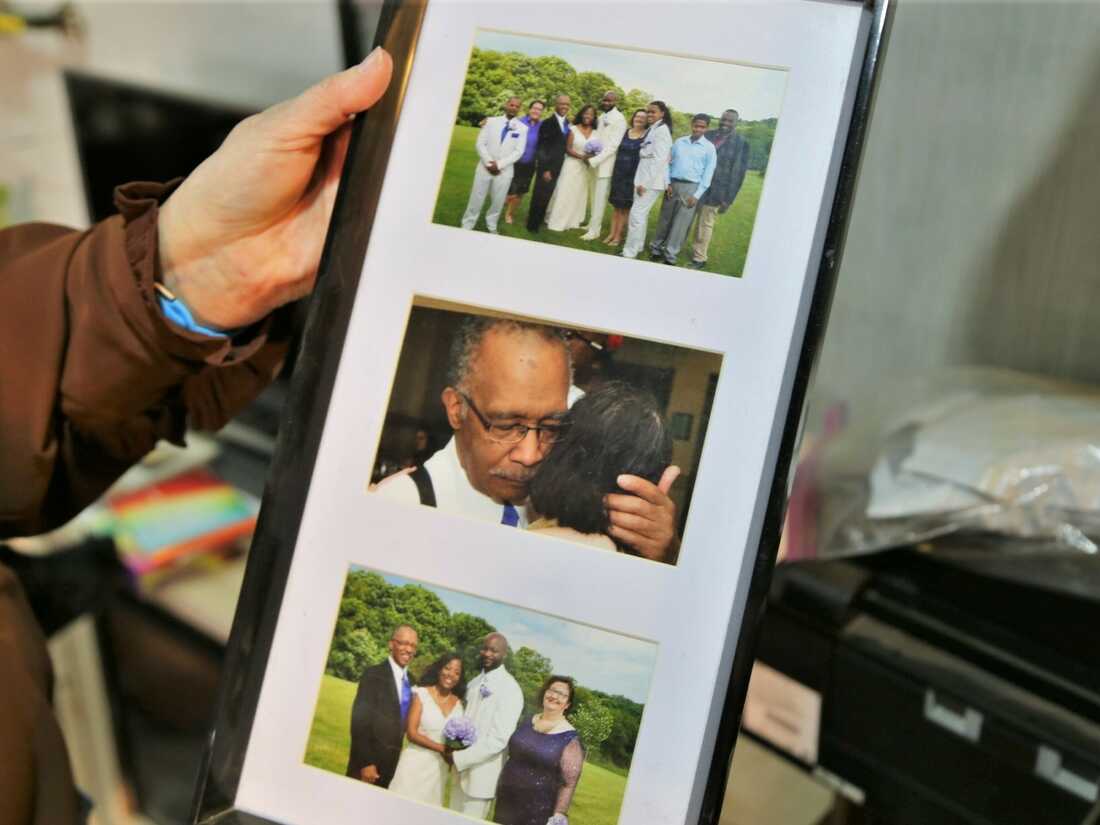

Sharon Gwinn holds an image of her husband, who had Lewy physique dementia towards the top of his life. Reckless monetary habits was one of many first indicators of the illness. “It is what attacked his mind first,” Gwinn says.

Katie Blackley/WESA

conceal caption

toggle caption

Katie Blackley/WESA

Sharon Gwinn holds an image of her husband, who had Lewy physique dementia towards the top of his life. Reckless monetary habits was one of many first indicators of the illness. “It is what attacked his mind first,” Gwinn says.

Katie Blackley/WESA

Sharon Gwinn had been married nearly 30 years when she cleared out the financial savings and checking accounts that she shared along with her husband, after which transferred that cash into accounts that had been solely in her title. It felt horrible, like she was stealing. However in need of shedding all the things, Gwinn was out of choices.

That was some 20 years in the past. Gwinn’s husband was nonetheless working as a hospital orderly when he began to spend cash erratically. One Thursday night time he racked up a $3,000 tab at a Pittsburgh cop bar, shopping for rounds for strangers. Gwinn says she found his splurge — one thing completely out of character for him — when her bank card was declined on the grocery retailer.

That is when she realized that her husband was displaying the primary of a sequence of cognitive adjustments that ultimately can be recognized as Lewy physique dementia.

“He drove for years after his monetary consciousness was gone,” Gwinn says. “It is simply this one space. It is what attacked his mind first.”

A rising physique of analysis reveals that folks with dementia face worse monetary outcomes. As NPR has reported, a 2020 examine from Johns Hopkins College of 81,000 Medicare beneficiaries discovered that folks with Alzheimer’s and associated dementias began to develop subprime credit score as much as six years earlier than a proper prognosis.

It’s amongst a cluster of research that level to monetary issues as a potential warning signal — relatively than simply the fallout — of cognitive decline.

Carole Shepard, a self-employed geriatric care supervisor in suburban Pittsburgh, says it is best to begin planning for the monetary implications of dementia when persons are nonetheless cognitively wholesome: “It is about controlling your individual future.”

Although there aren’t any good options, there are some steps you possibly can take to guard your self or your family members as you age. Right here is recommendation from monetary advisers and psychological well being professionals.

Put monetary guardrails in place prematurely

To keep away from surprises, some monetary advisers advocate having open conversations about cash with family members and organising instruments that observe your funds and flag any uncommon patterns.

Sharon Gwinn was capable of shield herself and her husband from monetary damage. However now, at 63 and a widow, Gwinn worries that if she, too, develops dementia, she might bankrupt herself earlier than anybody notices: “I might hazard a guess, my kids know far more about my funds than in all probability 90% of the folks in my age group. They nonetheless do not know what my day after day is.”

Specialists say Gwinn’s worry is an actual risk for thousands and thousands of Individuals, partially as a result of the monetary business has been hesitant to enact adjustments that may shield the wealth of growing old Individuals. That leaves people and households to hunt out safeguards.

The tech world provides some choices to people and households who’re in search of assist. In 2020 the Nationwide Institute on Getting old highlighted the work of SilverBills, a concierge service that makes positive payments are paid on time and inspects invoices for fraud and errors. The Cetera Monetary Group has partnered with Carefull, an internet firm that displays for fraud and monetary errors, whereas additionally offering id theft insurance coverage.

And because the AARP notes, EverSafe scans accounts for uncommon spending, comparable to the large bar tab that Sharon Gwinn’s husband tallied.

Sharon Gwinn would not need dementia to hurt her funds if she ought to come down with it. She designated her oldest daughter as her energy of lawyer and arrange a device to flag any uncommon monetary habits. This added safety makes Gwinn really feel lighter.”[My daughter] can hopefully assist me nip issues within the bud earlier than I get myself into hassle,” Gwinn says.

Katie Blackley/WESA

conceal caption

toggle caption

Katie Blackley/WESA

Sharon Gwinn would not need dementia to hurt her funds if she ought to come down with it. She designated her oldest daughter as her energy of lawyer and arrange a device to flag any uncommon monetary habits. This added safety makes Gwinn really feel lighter.”[My daughter] can hopefully assist me nip issues within the bud earlier than I get myself into hassle,” Gwinn says.

Katie Blackley/WESA

EverSafe says it could actually additionally assist forestall monetary fraud and exploitation — a serious scourge for older Individuals. The Nationwide Council on Getting old estimates that seniors within the U.S. lose $36.5 billion yearly attributable to elder monetary abuse. (Compared, final yr Individuals spent $45 billion in out-of-pocket prices on nursing residence and different institutional care.)

“These actually good scammers aren’t simply going to steal an enormous quantity from one account,” says Liz Loewy, EverSafe’s chief working officer, in addition to the previous chief of the elder abuse unit on the New York County District Lawyer’s Workplace. “They often are good sufficient to begin small and canopy a couple of account at a couple of establishment.”

Not everybody can afford a service like EverSafe: packages vary from roughly $7 to $26 a month. However such a service might need helped Gwinn, who could not forestall her husband from signing up for brand new bank cards even after she took management of the couple’s funds. After consulting her 4 kids, she determined to buy the essential bundle for herself.

Now Gwinn’s oldest daughter, who’s designated as her energy of lawyer, can be notified if EverSafe flags something uncommon. This added safety makes Gwinn really feel lighter.

“[My daughter] can hopefully assist me nip issues within the bud earlier than I get myself into hassle,” Gwinn says.

Work collectively to arrange a collaborative plan with your loved ones

Much more than monetary monitoring, arguably a very powerful factor you are able to do is to contain your loved ones or pals in a collaborative plan round growing old and funds — ideally earlier than any signs of dementia seem.

Carole Shepard, a geriatric care supervisor, and her husband each have household histories of dementia. They’ve drafted intensive monetary plans and shared them with their grownup kids. “Hope will not be a method,” she says.

Katie Blackley/WESA

conceal caption

toggle caption

Katie Blackley/WESA

Carole Shepard, a geriatric care supervisor, and her husband each have household histories of dementia. They’ve drafted intensive monetary plans and shared them with their grownup kids. “Hope will not be a method,” she says.

Katie Blackley/WESA

That is simpler stated than achieved, says Matt Lundquist, a New York Metropolis-based therapist who usually works with households on points round cash — comparable to budgeting or caring for an aged mother or father.

Cash can signify stability, management, energy, autonomy and security, Lundquist notes. Due to this fact, addressing the monetary security issues requires folks to acknowledge the inevitability of demise — their very own and that of these they love — in addition to the bodily, psychological and financial realities of growing old. Even in one of the best of circumstances, cash is a sensitive topic — one that may elevate discomfort and hackles, and one that’s usually thought of nobody else’s enterprise

It is essential to not blindside members of the family with this huge discuss; as a substitute, Lundquist advises that folks give a heads-up that cash points should be mentioned: “It makes a troublesome dialog more likely to go nicely.”

The dialog ought to cowl matters comparable to deciding on a monetary energy of lawyer, the best way to safeguard in opposition to exploitation, and the obligations of day-to-day cash administration. A information from the College of Minnesota provides a number of sensible recommendation on all the things from deciding on a monetary advocate to a listing of necessary paperwork and the best way to full a monetary stock.

Carole Shepard, the Pittsburgh-based geriatric care supervisor, warns that tough conversations are mandatory and conflicts are inevitable, particularly after they contain somebody with progressive dementia. Too usually, she sees her older shoppers in disaster as a result of their hope had been that at some point they’d peacefully die of their sleep with none of the humiliations of growing old.

“Hope will not be a method,” she says.

That is why Shepard and her husband, each of their 60s and each with household histories of vascular dementia, have drafted intensive plans which they’ve shared with their grownup kids. They appointed their youthful son as monetary energy of lawyer and their older son as medical energy of lawyer. By making these choices now, Shepard and her husband consider — hope — they’re preserving their autonomy.

Shepard additionally hopes that being proactive will make it simpler on her household, each emotionally and financially, as she and her husband proceed to age.

Sharon Gwinn feels the identical method: “I don’t need my kids to be accountable for taking good care of me. What I’ve, I need my cash to be spent for my care, and I do not wish to burden them.”

If dementia has already set in, embrace family members in decision-making as a lot as potential

Each Gwinn and Shepard know that in the event that they do ultimately develop dementia, all their planning will not shield their kids from a point of hardship. Signs are unpredictable and variable: despair, irritability, paranoia, impulsiveness. That creates a dilemma for grownup kids: Pushing assist onto resistant dad and mom incites strife; ignoring actuality begets neglect.

“The reality is it should be troublesome, and the possibilities of full success aren’t excellent,” says Bob Levenson, a professor on the College of California, Berkeley who specializes within the emotional adjustments that accompany growing old.

Levenson’s greatest recommendation for caregivers and family members is to incorporate the individual with dementia within the decision-making course of as a lot as potential. If an individual cannot articulate their wishes, it is nonetheless necessary to think about the values and pursuits they held whereas wholesome.

For instance, maybe a lifelong soccer fan is now not able to paying their very own payments; the individual in control of their month-to-month price range might embrace a cable bundle that enables them to observe NFL video games.

It is essential to keep in mind that the illness is the enemy, Levenson says: “In some way, it’s important to attempt to discover a solution to keep on the identical aspect with the one you love and never find yourself blaming one another.”

Sarah Boden’s reporting on dementia and monetary decision-making is a part of a fellowship with the Affiliation of Well being Care Journalists, supported by The Commonwealth Fund.

[ad_2]